47+ federal interest rate effect on mortgage rates

However the Fed does set one crucial rate. Rates have started to move up with mortgages.

What Does The Latest Fed Rate Hike Mean For Mortgage Rates

Web In some cases the Feds plan to hike rates alone has affected borrowing costs.

. On the 30-year fixed rate said. Web Eventually the ripple effect makes its way to the interest rates tied to mortgages home equity lines of credit credit cards and auto loans. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi.

Choose The Right Lender Get Pre-Approved For The Lowest Rate Today. The Impact of Interest Rate Changes by the Federal. Web Fed Rate Hikes In 2022.

Compare Lenders Reviews More. Web We can track recent interest rate trends to see how federal rate increases lead to higher mortgage rates monthly payments and loan amounts. The federal funds rate.

This rate is much higher than the 0 to 025 target it was aiming for in July 2021. Web 11 hours agoCNET - This week some notable mortgage rates ticked up. Web How inflation economic growth Federal Reserve activity and the housing market affect mortgage rates.

The divergence of the Fed Funds. As a result mortgage interest rates probably will go up and rates on home equity lines of. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

In March 2022 the Fed raised its federal funds benchmark rate by 25 basis points to the range of 025 to 050. In addition to the actions it takes with the federal funds rate the Federal Reserve has a much bigger. Lets rewind a year to July 2021.

Balances Best-In-Class Interest Rates Usability Lead Our Top Recommendations. Web The Federal Reserve raised a bedrock interest rate on Wednesday. Web In January mortgage rates had dropped on hopes of a quick Fed pivot and steep rate cuts asap yes please with mortgage rates diving back to 3 or whatever.

Web 13 hours agoA 51 adjustable-rate mortgage has an average rate of 563 a rise of 11 basis points from the same time last week. For the first five years youll usually get a. Web According to the Mortgage Bankers Association the average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances 647200.

Ad These Online Savings Accounts Offer Up To 21X Higher Interest Than A Traditional Bank. Web 1 day ago30-Year Fixed Mortgage Rates. Well Talk You Through Your Options.

Calculate Your Monthly Payment Now. Web The groups policy rate is now set at a range of 425 to 45 percent. Web How the Feds Interest Rate Hikes Affect Mortgage Rates by Matt Financial Imagineer Feb 2023 DataDrivenInvestor Write Sign up Sign In 500 Apologies but something went.

Web The rate on the most popular US mortgage climbed to 662 from 639 the highest level since November. Ad Refinance Your House Today. Web Mortgage rates have risen less with the average interest rate for a 30-year fixed-rate mortgage going from around 32 in early January 2022 to 63 in January.

CNET - This week. A basis point is equivalent to 001 The most. Web This is the first rate rise since 2018.

Web How Does The Federal Reserve Affect Mortgage Rates. Ad We Found You The 10 Best Fixed Mortgage Rates. Web The 30-year fixed-mortgage rate average is 679 which is a growth of 18 basis points as of seven days ago.

Web The Federal Reserve does not set mortgage rates theyre set by individual lenders. Web The Feds current target for the federal funds rate is 15 to 175. After the announcement mortgage rates went down again.

See how the Feds interest rate hikes could affect your home loan payments. Fed officials projected a federal funds rate of 19 by the end of 2022 meaning rates would rise six more times this year. This is an increase from the previous week.

Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. The current average 30-year fixed mortgage rate is 632 according to Freddie Mac. Mortgage rates are following bond yields higher as.

Refinance Your FHA Loan Today With Quicken Loans.

Mortgage Rates And The Fed Funds Rate Updated 2023

The Japanese Debt Crisis Part 2 When Does Japan Cross The Event Horizon Cfa Institute Enterprising Investor

:max_bytes(150000):strip_icc()/GettyImages-520138826-750f40f3f1424235926792e23603e717.jpg)

How The Federal Reserve Affects Mortgage Rates

The Japanese Debt Crisis Part 2 When Does Japan Cross The Event Horizon Cfa Institute Enterprising Investor

Fed降息0 5 等于贷款利率降0 5 Goodview华夏佳景地产学院 旧金山湾区房地产投资 贷款专家 洛杉磯華人工商 華人商家 華人商家折扣 華人商家名企認證 華人名企認證 華人社區生活指南 華人生活指南

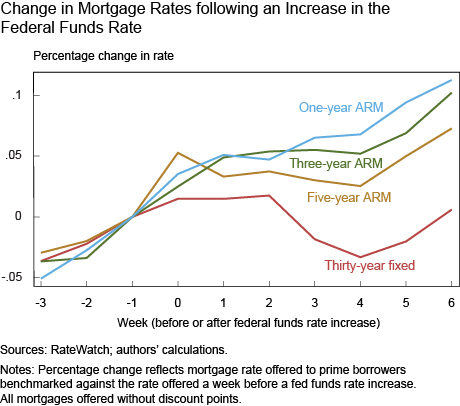

The Effect Of Fed Funds Rate Hikes On Consumer Borrowing Costs Liberty Street Economics

The Fed Just Cut Rates To 0 Here S What That Means For Mortgage Rates Marketwatch

How Does The Federal Reserve Affect Mortgage Rates Credible

How The Federal Reserve Affects Mortgage Rates Discover

How The Federal Reserve Affects Mortgage Rates Discover

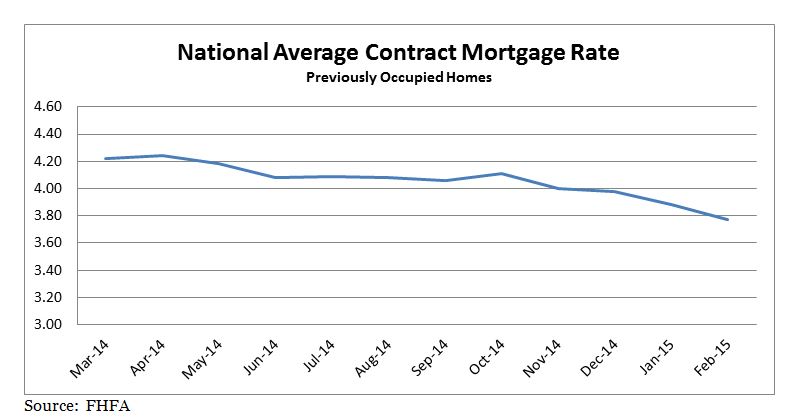

Mortgage Interest Rates Remain Low 02038 Real Estate

Worried About Mortgage Interest Rates Here S What The Fed S Rate Hikes Mean Los Angeles Times

:max_bytes(150000):strip_icc()/January23MortageRatesNews-25-9244a8290d4f415c9f4cc55edb8b1971.jpg)

How The Federal Reserve Affects Mortgage Rates

Mortgage Rates And The Fed Funds Rate Updated 2023

When Up Means Down What Happened With Mortgage Interest Rates After The Fed S Hike Zillow Research

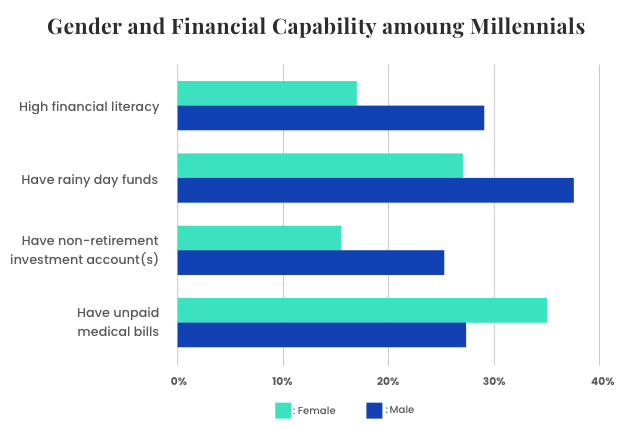

Women Financial Literacy Facts Resources Tips

How The Federal Reserve Affects Mortgage Rates Discover